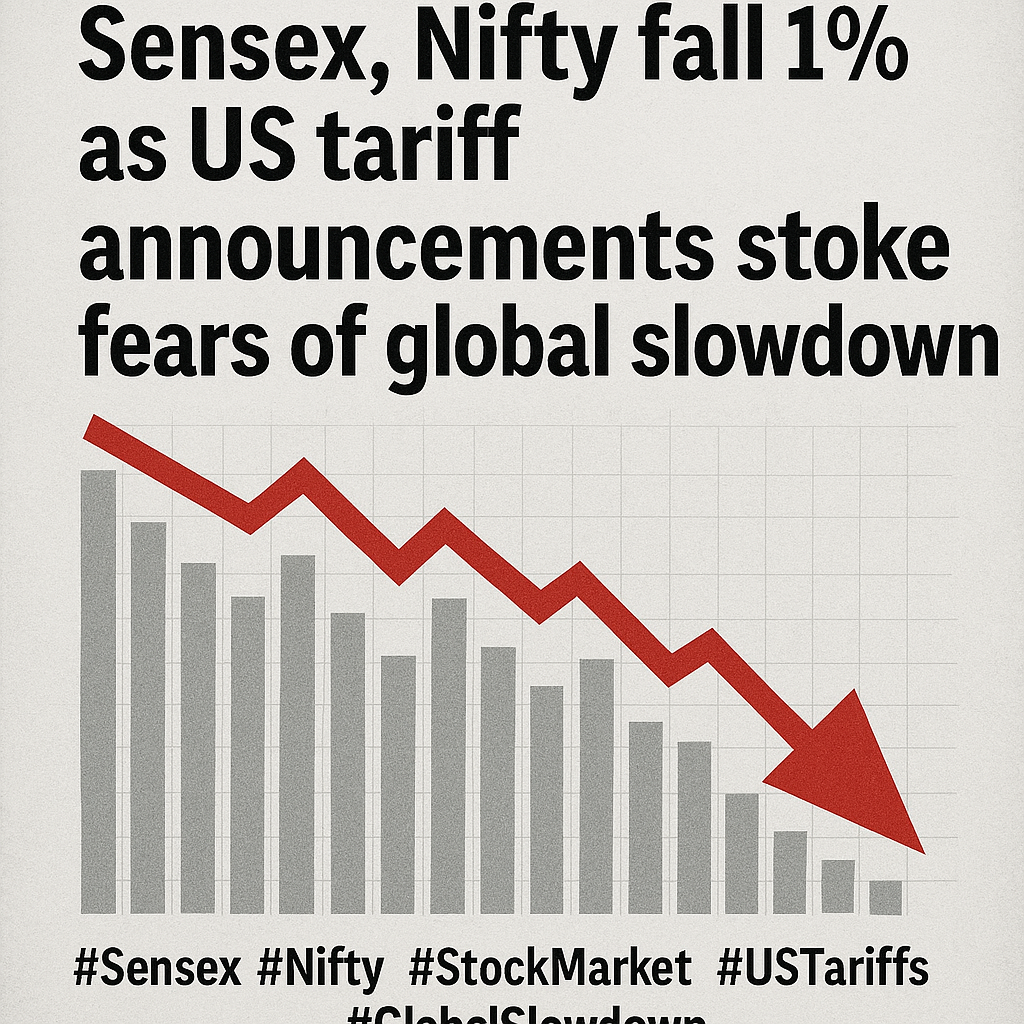

Indian equity markets witnessed a sharp decline on Thursday as both the Sensex and Nifty fell by nearly 1%, tracking global market weakness triggered by the latest round of US tariff announcements. The Sensex plunged over 650 points intraday before closing lower by 580 points, while the Nifty closed below the 22,000 mark, reflecting broad-based selling across sectors.

Investor sentiment turned cautious after the US government unveiled a new set of tariffs targeting strategic imports, including key goods from China and other trading partners. Market participants fear these protectionist moves could escalate global trade tensions and hurt economic growth, particularly at a time when global recovery remains fragile.

The ripple effect was seen across Asian and European markets, with key indices in Japan, Hong Kong, and Germany also ending in the red. Back home, sectors such as IT, metals, and auto were among the worst hit, as fears of reduced global demand weighed on outlooks.

Foreign institutional investors (FIIs) were net sellers in today’s session, further adding to the pressure on Indian equities. The broader markets also saw declines, with mid-cap and small-cap indices underperforming the benchmarks.

Analysts caution that volatility may remain high in the coming days as investors digest the geopolitical developments and await further clarity on the extent and enforcement of the new US tariffs.

🗣️ Expert Take:

“Markets are reacting to the rising global uncertainty. The tariff announcements have raised concerns of another phase of trade disruption, which could be detrimental to export-driven economies like India,” said Rajesh Gupta, Senior Market Analyst at EquityX.

📊 Closing Stats:

-

BSE Sensex: -580 pts (-0.98%)

-

NSE Nifty 50: -168 pts (-0.92%)

-

Top Losers: Tata Steel, Infosys, Maruti Suzuki

-

Top Gainers: HDFC Bank, Bharti Airtel (limited upside)